With a client-centric approach and a commitment to providing innovative solutions, the company has quickly gained a strong foothold in the market. Tickmill’s rapid growth is attributed to its dedication to delivering exceptional trading conditions and outstanding customer service. If an account falls below a zero balance, Tickmill will cover the debt by providing Negative Balance Protection.

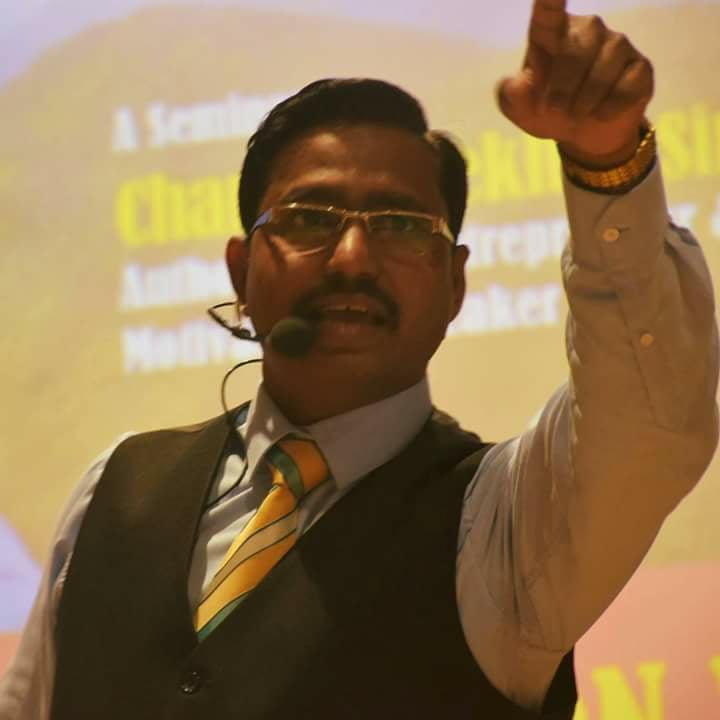

The speaker is good and explains the topics well, especially the fundamental analysis. The speaker has extensive knowledge in forex trading so he can share many experiences as a long time trader. I have started trading in the live account and I highly recommend this broker because of the low spread and low commission. Trading with Tickmill will involve fees from $100 USD, spreads from 0.00 pips to 1.6 pips, and commission-free trading depending on the account traders select. A minimum deposit of $100 USD is required to open a Tickmill Live trading account.

- We withdrew our funds via the four payment methods we used to make our initial deposits to test all the available withdrawal options.

- Long-term investors also have an opportunity to trade towards a positive swap.

- All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

- They provide trading services in over 87 instruments via the MT4 platform, offering competitive spreads and commissions, advanced trading tools, and fast executions.

- Usually, one article with fundamental market analysis is published a day.

Our team conducts thorough testing on a wide range of brokers, platforms, products, technologies, third-party trading tools, and mobile apps. We also test for the availability of high-quality educational content, actionable market research resources, and the accessibility and capabilities of mobile platforms. All of our ratings and rankings are based on the collection and validation of thousands of data points and our in-depth product testing.

There are also educational features such as Webinars, Seminars, Ebooks, and Video Tutorials. All of these facilities can be used by traders to increase knowledge about trading and the financial market as a whole. If traders already have enough knowledge, they have a greater opportunity for earning profit consistently. After registering in Tickmill, traders can choose the most ideal asset among 60 currency pairs that they can trade. If traders aren’t sure yet to open a real account, Tickmill recommends learning to trade through a demo account. I am Padmapriya and have an account with Tickmill Seychelles.

Tickmill Review 2021

Seriousness, competence, honesty, customer service, quick withdrawals and one of the lowest spreads on the market. I’ve been a customer for almost four years and I’m 100% satisfied! I recommend it to everyone, and a special hug to my account manager Brunno Huertas who has always served me with excellence. The Tickmill platform currently supports a number of different eWallet solutions.

To open an Islamic account, you should contact Tickmill customer support and they will process the request within one business day. If you plan to open multiple accounts with Tickmill, any future accounts will also be swap-free, saving you time. There are three main types of accounts outlined in this review, with some other variations available.

Popular Forex Guides

According to the rules of Tickmill, demo accounts that have not been used for more than 7 days are automatically deactivated. In order to open an Islamic account, you first need to open and verify the account and then send a request to the customer support. The selection of base currencies (EUR, USD, GBP), settings of leverages and admissible strategies are similar for all account types.

Technical analysis

It offers optimal conditions with fast order execution while enabling traders to use virtually any trading strategy. Additionally, the account is trade commission-free so traders only pay the bid/ask spread. Other than the tickmill review 3 main accounts above, Tickmill also provides an Islamic account (swap-free). Our editorial team is led by Steven Hatzakis, an industry veteran with decades of experience and a deep understanding of the forex market.

Best Forex Trading Signal Providers

Tickmill’s customer support team was helpful and provided relevant answers to our questions. In our tests, we chose the popular instrument in each market. We placed 3 trades for each instrument to get a complete picture of the average spread.

Great Service by Daniela

Some brokers also charge additional fee for position rollover, which is why the values of the swaps may differ. According to our research, Tickmill customers from different parts of the world have different preferences. European mostly open accounts in the Cyprus jurisdiction (Tickmill.eu) or UK (Tickmill.co.uk), while the rest of the world prefers to be serviced in the offshore territory in the Seychelles. Despite the fact that Tickmill is not included in the top brokers, I prefer this particular company. The British regulation inspires confidence and a positive reputation. Tickmill has over 327,000 clients and more than 668,000 registered accounts.

If you fund your account using other currencies, the funds are automatically converted into the account currency. Please note that in the upper part of the questionnaire, there is the so-called ‘jurisdiction selector’. As a broker’s customer, you can choose the regulator, for example FCA (UK) and FSA (Seychelles).

Despite that Tickmill LTD branch is based in an offshore territory, the procedure of opening an account on tickmill.com is more similar to opening an account in a more strictly regulated area. Overall, we estimated convenience and thorough approach to the procedure as the broker’s advantages. Having CQG platform and an account with a balance of USD 1,000 or more on Tickmill UK, the customers receive access to 5 futures markets – CBOT, CME, COMEX, NYMEX and EUREX. I spent several months trading with Tickmill, earned USD 200 and withdrawn it smoothly. Remember, trading involves inherent risks, and it’s essential to educate yourself and make informed decisions.